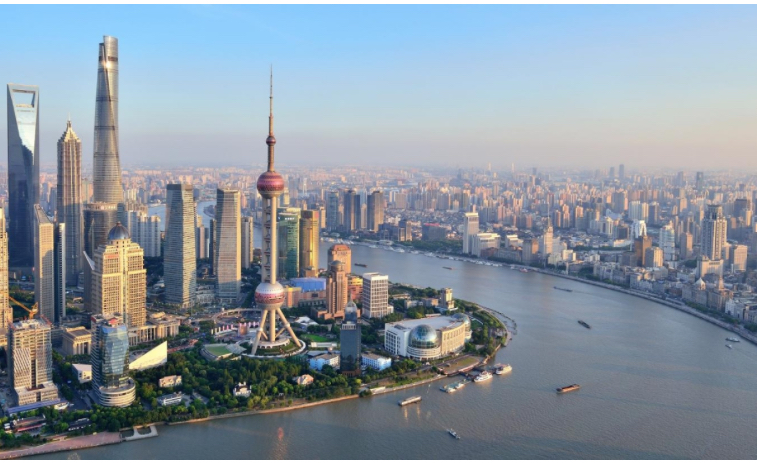

Lujiazui area in Shanghai Photo:Xinhua

Chinese officials on Wednesday announced a package of major policies to support stabilizing the market and expectations, including lowering the policy rate and reserve requirement ratio (RRR), while projecting strong confidence in the country’s high-quality development.

The moves highlighted sufficient policy tools at Chinese policymakers’ disposal to not only ensure stable and sound development in the world’s second-largest economy, but also to boost innovation and promote high-quality development despite global economic uncertainties, experts said.

At a closely watched press conference on Wednesday morning, Pan Gongsheng, governor of the People’s Bank of China (PBC), the central bank, announced 10 measures across three areas, including a cut of 0.5 percentage points to the RRR, which is expected to inject about 1 trillion yuan ($138.56 billion) in long-term liquidity into the market.

From both macro and micro perspectives, the RRR cut is expected to serve multiple purposes, including boosting domestic demand and accelerating structural adjustments, Lian Ping, director and chief economist of the Guangkai Chief Industry Research Institute, told the Global Times on Wednesday.

Among the other major policies measures, the seven-day reverse repo rate, another main policy rate, will be lowered from the current 1.5 percent to 1.4 percent, which will drive the loan prime rate down by 0.1 percentage points, Pan said.

Moreover, monetary authorities will improve the reserve requirement system, and reduce the RRR for auto financing firms and financial leasing firms from 5 percent now to zero, Pan noted.

The central bank also announced that it will lower the interest rates on personal housing provident fund loans by 0.25 percentage points starting Thursday. The adjustments are expected to save homebuyers more than 20 billion yuan in annual mortgage interest payments through the housing provident fund, Pan said.

Pan also announced other new policy tools at the press conference, including a 500-billion-yuan relending facility aimed at enhancing the supply of services and eldercare. The “services consumption and eldercare relending program” is an innovative move by the PBC to support consumption, he said.

At the press conference on Wednesday, officials from other top financial regulators also announced various policy measures. Li Yunze, head of the National Financial Regulatory Administration (NFRA), announced that a set of policy measures will be introduced to support the foreign trade sector through the banking and insurance system, when addressing the disruptions to global trade caused by the US tariffs.

Specifically, targeted services will be provided to market entities heavily affected by tariffs, with efforts focused on helping them stabilize operations and expand market access.

Wu Qing, chairman of the China Securities Regulatory Commission, also outlined at the press conference comprehensive plans, including developing technology innovation bonds and attracting long-term funds, to ensure sound and stable development of the capital market.

The sweeping new measures follow a key meeting held recently by the Political Bureau of the Communist Party of China Central Committee, which emphasized the need to stabilize employment, businesses, markets and expectations, using the certainty of high-quality development to counter the uncertainties arising from rapid changes in the external environment.

The measures also came as the US’ tariffs have caused profound disruptions to global trade and the world economy.

Asked to comment on the recent repeated claims by the US that the high additional tariff is unsustainable for Beijing, Chinese Foreign Ministry spokesperson Lin Jian said on Wednesday that no external shocks can change China’s economic fundamentals, which have a stable foundation, numerous strengths, remarkable resilience and vast potential; nor can they change the consistent trend of China’s steady progress in pursuing high-quality development.

“China is highly resilient under pressure and has a full toolbox to defend our legitimate rights and interests, and stand ready to work with the international community to enhance solidarity and coordination, jointly oppose unilateralism, protectionism and economic bullying, safeguard multilateral trading system and uphold international fairness and justice,” Lin told a regular press briefing.

Despite significant external shocks, China’s economy has maintained stable growth, with the GDP growing by 5.4 percent year-on-year in the first quarter. Since April, China’s financial system has also remained stable, with financial markets showing strong resilience. After a drop on April 7, the Shanghai Composite Index quickly rebounded and stabilized. The yield on 10-year government bonds has hovered at about 1.65 percent, while the yuan, having weakened slightly against the US dollar, has since recovered to about 7.2, Pan noted.

Amid rising external risks, financial regulators are not only working to prevent market turbulence but also rolling out additional policy support, helping to strengthen and reinforce backing for the real economy, Yang Chang, chief analyst of Zhongtai Securities Co, told the Global Times on Wednesday.

Yang noted that the latest policy measures not only strengthen risk prevention but also highlight a strong focus on technology, which is key to China’s pursuit of innovation-driven, high-quality development.

In this regard, the central bank will increase the quota of relending for technological innovation and upgrading by 300 billion yuan to a total of 800 billion yuan, Pan announced.

The NFRA is also accelerating the formulation of guidelines to promote the high-quality development of tech insurance, aiming to enhance its role in risk sharing and compensation, according to Li.

As China’s high-quality development advances, technological innovation is moving to a new level, a trend that is both evident and irreversible, Dong Shaopeng, a senior research fellow at the ChongyangInstitute for Financial Studies at Renmin University of China, told the Global Times on Wednesday.

China has made remarkable progress in technological innovation, with impressive advances in areas such as new-energy vehicles, green energy, the industrial internet, large-scale artificial intelligence models and embodied robotics, Dong said.

The expansion of technology investment funds and efforts to encourage banks to grow their financial asset investment arms underscore China’s determination to achieve technological self-sufficiency in the face of rising US export barriers. These measures aim to channel capital into strategic sectors, bolster domestic innovation and reduce reliance on foreign technology, DBS analysts led by chief China analyst Ji Mo wrote in a note sent to the Global Times on Wednesday.

“Against this backdrop, we expect fixed-asset investment in high-tech industries to continue outperforming other areas, serving as a key pillar of China’s structural growth,” the analysts said.

Notably, while global markets encountered severe turbulence since the US announced tariffs, several global institutions have upgraded their ratings on Chinese stocks.

For example, Citi analysts downgraded their rating on US stocks from “Buy” to “Neutral,” citing expectations that the US economy may not outperform other regions in the coming months. In contrast, they upgraded their rating on Chinese stocks from “Neutral” to “Buy,” according to a report.

globaltimes.cn

Africa -China Review Africa -China Cooperation and Transformation

Africa -China Review Africa -China Cooperation and Transformation